1099 Tax Forms are available now on MySealaska!

Wednesday, January 17, 2024

Sealaska shareholders are now able to view and download their IRS Form 1099-DIV for 2023. Printed 1099 tax forms will be mailed on or before Jan. 26.

How to find your 1099-DIV on MySealaska.com

Go to About Me > 1099s

Q: Why am I getting a 1099? I thought my distributions were tax free now that we have the Sealaska Settlement Trust?

A: The Sealaska Settlement Trust was created by a vote of shareholders in June of 2021.

Q: Why am I getting a 1099? I thought my distributions were tax free now that we have the Sealaska Settlement Trust?

A: The Sealaska Settlement Trust was created by a vote of shareholders in June of 2021.

- Distributions from Sealaska operations and the Marjorie V. Young (MVY) investment fund are tax free.

- ANSCA Section 7(j) payments to shareholders (Class B, C) will remain taxable income. Urban and At-Large shareholders (class B, C) will receive a 1099 tax form for 7(j) payments.

- For more information on the Sealaska Settlement Trust, click here.

Q. Why do I not have any 1099 information reported for the year?

A: Shareholders who have ONLY Class A, D, or E stock receive their dividends through the Settlement Trust or the Marjorie V. Young (MVY) Investment Fund, both of which are tax free. Shareholders of these stock classes will not receive a 1099 and do not need to report their dividends to the IRS.

A: Shareholders who have ONLY Class A, D, or E stock receive their dividends through the Settlement Trust or the Marjorie V. Young (MVY) Investment Fund, both of which are tax free. Shareholders of these stock classes will not receive a 1099 and do not need to report their dividends to the IRS.

Latest News

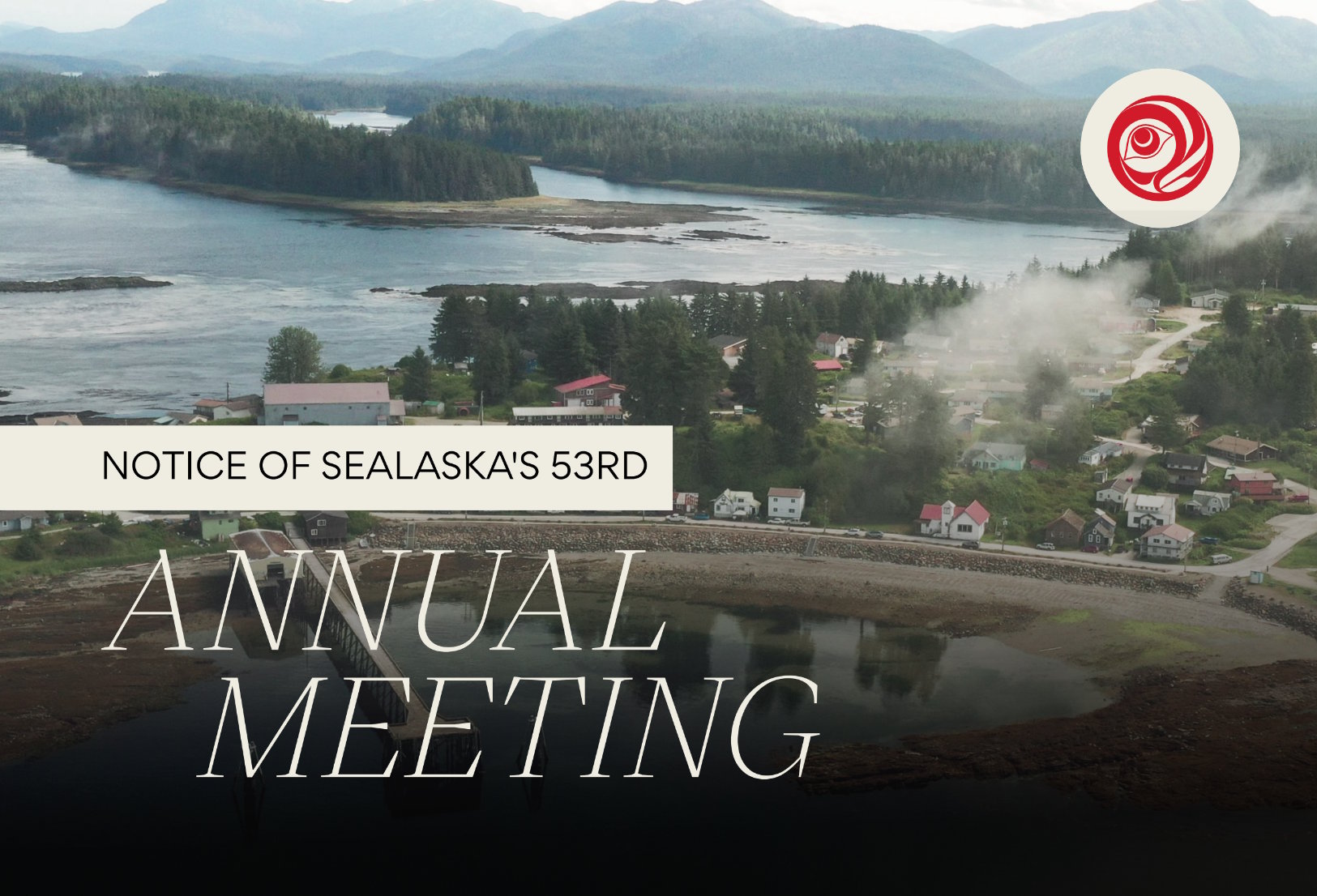

Notice of Sealaska's 53rd Annual Meeting of Shareholders

Pinned - Posted 2/12/2026The 2026 Sealaska Annual Meeting of Shareholders will be held on Saturday, June 27, in Angoon, Alaska. This year’s meeting will take place at the Angoon Elementary Gym, located at 500 Big Dog Salmon Road, Angoon, AK 99820.

Sealaska Welcomes Madeline Soboleff Levy

Posted 2/7/2026Sealaska welcomes Madeline Soboleff Levy as our new Vice President of Policy and Corporate Affairs.

Online Notary Service for Stock Wills

Posted 1/28/2026Sealaska is pleased to welcome Heather Shá xat k’ei Gurko

Posted 12/17/2025Sealaska is pleased to welcome Heather Shá xat k’ei Gurko as our new Director of Shareholder Communications.

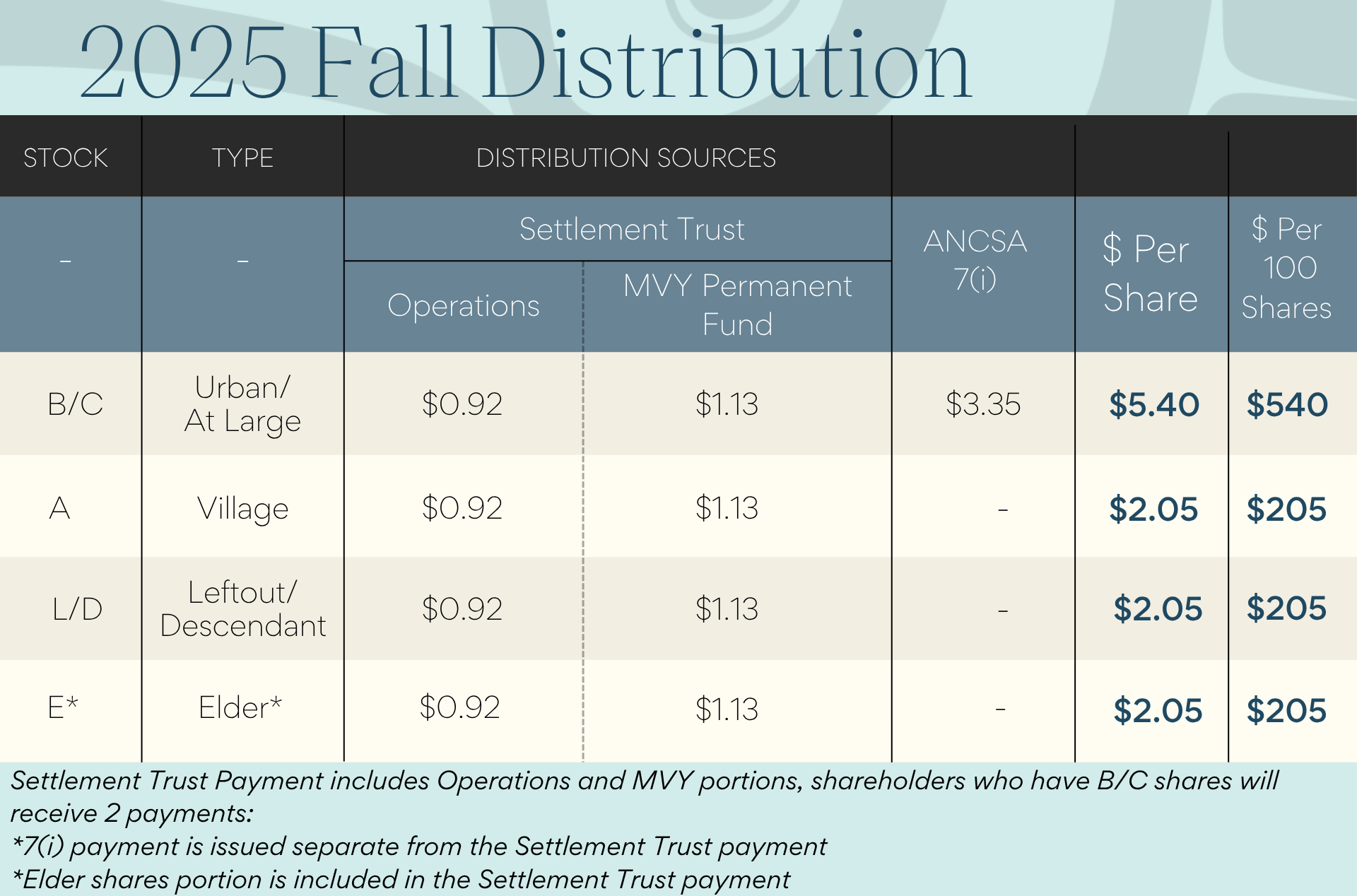

Sealaska Announces Fall 2025 Distribution of $11.8 Million

Posted 11/12/2025

Sealaska is announcing a Fall 2025 distribution totaling $11.8 million, to be issued to shareholders on Thursday, November 13. The board of directors approved the distribution at its meeting on Friday, November 7. The upcoming distribution includes $2.9 million in dividends from Sealaska’s operations, $3.6 million from the Marjorie V. Young (MVY) Shareholder Permanent Fund, and $5.3…