First Distribution from Settlement Trust Slated for Fall 2021

Thursday, August 12, 2021

Sealaska shareholders approved a resolution to establish a settlement trust for Sealaska by a margin greater than three to one during the election that concluded Saturday, June 26.

The trust, which is similar to those established by dozens of other Alaska Native regional and village corporations, will free Sealaska shareholders from paying federal income tax on their dividends. It will also reduce Sealaska’s tax obligation to the federal government in the future. This benefits all of us.

The trust is a financial and legal instrument, and there are a lot of technicalities, but it is at the end, beneficial to Sealaska’s shareholders. Sealaska will work to maintain the Trust as accountable to shareholders and will help set up processes and policies that aim to maximize the benefits we can offer shareholders. Please read on for answers to questions submitted by our shareholders during the 2021 election season and some new information related to the upcoming distribution in late October of 2021. The information below is organized into four general categories to help you more easily navigate this post. Use the section headers below to jump to the information you’re interested in:

And please – if you have a question that isn’t addressed here, get in touch with us at corpcomm@sealaska.com. We are committed to providing as much information as we can as now that this new tool is available to us.

GENERAL INFORMATION

What is a Settlement Trust?

Under the Alaska Native Claims Settlement Act, Sealaska can set up a special entity called a “Settlement Trust” that is legally separate from the company to provide benefits to shareholders and descendants. The purpose of a Settlement Trust is to provide for the health, education, cultural preservation and economic welfare of Alaska Native people and descendants who are the “beneficiaries” of the Settlement Trust.

Now that Sealaska has a settlement trust, dividends will be paid via the trust rather than directly from Sealaska. From the standpoint of the shareholder, especially if you’re enrolled in direct deposit, you will not notice any difference. Your distributions will come twice a year as they always have, and will be the same amount as they otherwise would’ve been. (Shareholders who receive their dividends by mail will see a different entity named on the check they receive, but otherwise will not notice any difference.) The biggest difference is that your Sealaska distributions will not be taxable by the federal government. (Distributions from ANCSA Section 7(j) will still be taxable.)

From a technical standpoint, Sealaska will transfer money from the corporation to the trust and the trust will issue the dividend.

When will it go into effect?

Shareholders will receive their first distribution via the trust in the fall of 2021. You will receive a 1099 from Sealaska for the spring 2021 dividend, but your fall distribution will not be subject to federal tax (excluding payments made from the ANCSA Section 7(i) program).

Common terminology associated with a Settlement Trust

Settlement trusts use different words for many of the concepts you’re familiar with as a shareholder or descendant of Sealaska.

We call it…

Shareholder

Shares

Dividend

Member of Sealaska’s Board of Directors

In a settlement trust it’s…

Beneficiary

Units

Distribution

Trustee

Why did Sealaska propose a settlement trust?

It’s a great opportunity for Sealaska, and for our shareholders! While settlement trusts have been an option for Native corporations for decades, changes to federal tax law in 2017 made settlement trusts particularly beneficial to Alaska Native Corporations and their shareholders. The new tax law allows Native corporations to make contributions to a settlement trust using pre-tax dollars. This change will reduce the amount of corporate income tax Sealaska pays to the federal government, creating a cash savings that can then be used to earn additional income or fund shareholder programs. Settlement Trust distributions to shareholders will not be subject to federal tax!

Is it risky to get Sealaska involved in an unknown venture like settlement trusts?

Settlement trusts are not new. They have been used by Native corporations in Alaska since the late 1980s and have been approved by shareholders of Ahtna Inc., Bering Straits Native Corporation, Calista Corporation, Cook Inlet Region Inc. and NANA Regional Corporation, along with many village corporations in our region including Goldbelt, Inc., Kootznoowoo, Inc., and Huna Totem.

In fact, Sealaska already has an established Elders’ Settlement Trust for one-time payments to shareholders of Class A, B and C stock when they reach the age of 65.

The relatively new tax law, however, allows Sealaska’s new settlement trust to benefit all Sealaska shareholders and descendants year after year.

WHAT DOES IT MEAN FOR ME?

What does tax-free distributions mean?

Shareholder distributions from the proposed settlement trust are not subject to federal income tax. Beneficiaries may still be subject to state tax, however. In Alaska and Washington, where most of our shareholders live, there is no personal income tax, so distributions will be 100% tax free. Elsewhere, distributions could be taxed if the state where you live has personal income tax. ANCSA Section 7(j) distributions will still be taxable.

Will shareholder benefits change with a settlement trust?

No. The settlement trust will be used to make distributions. (The term “distribution” is used in place of “dividend” when it comes from a trust instead of directly from the company, but there’s no difference otherwise. See this item above for an explanation of terminology.) Dividend calculations and distributions will not change.

Under the settlement trust, there are other benefits that could be utilized in the future that could offer greater tax savings or improved programs for shareholders. Sealaska will consistently look to maximize the benefits of the Trust for our shareholders.

How will shareholders receive distributions from the settlement trust?

Distributions will be paid to shareholders the same way dividends are now. When the board meets in April and October, it decides how large the distribution will be. Shareholders receive their distribution based on how many shares they own and the classes of shares. With the Settlement Trust, the board will vote to send the total distribution amount to the Settlement Trust, and the trust will issue distributions to shareholders. The only difference shareholders will notice is that with the Settlement Trust, you won’t have to pay federal taxes on your distributions. Sealaska will benefit by receiving a federal tax deduction for the money transferred to the trust, reducing the amount of tax it pays. (ANCSA Section 7(j) distributions will still be taxable.)

Will shareholders lose shares with a new settlement trust?

Dividend calculations and distributions will not change. If you have 100 shares of Sealaska stock, you will own 100 units in the Settlement Trust (see above for an explanation of terminology). Your shares in Sealaska will still exist, and can still be gifted or willed as they are now. For example, if you gifted 10 shares of Settlement Common Stock in Sealaska to your grandchild, your grandchild will receive those shares as well as 10 distribution-paying units in the Settlement Trust.

PROXY LANGUAGE

Do unclaimed distributions dissolve Sealaska stock?

If a shareholder does not claim their trust distribution after five years, the money will go back into the trust. The money will then be invested or redistributed to shareholders. Failing to claim dividends or distributions from the Settlement Trust does not dissolve Sealaska stock.

What will Sealaska do with unclaimed distributions after five years?

Sealaska is creating a process in coordination with the Settlement Trust to ensure no loss of dividends for shareholders if they face a gap in claiming their distributions, just like Sealaska currently follows for unclaimed dividends. Shareholders do not lose their stock rights if they do not claim dividends for five years and will remain beneficiaries of the trust. Shareholders would continue to “earn” distributions.

The resolution language said funds may be distributed on a basis other than per-share. What does that mean?

It means that Sealaska could transfer funds for some programs, like the scholarship program, to the trust. Scholarships are awarded when qualifying shareholders apply, not on a per-share basis. Right now, though, the plan is to use the trust only for distributions.

This language was confusing for some, but we are committed to expanding and improving shareholder benefits and proposed this trust because we believe it will help us do that. There is no immediate plan to change any benefit structure or formula currently in use by Sealaska, and Sealaska has historically been able to stand up important shareholder programs while keeping distributions stable.

If we were to use the trust to pay for something like scholarships in the future, we would move extra money into the trust. It would not pay for scholarships at the expense of distributions. Sealaska will continue to fund programs to benefit shareholders.

GOVERNANCE

Who will manage the settlement trust?

The settlement trust is governed by a 13-member board of trustees. The board of trustees is made up of all 13 members of Sealaska’s Board of Directors. Board members will not receive additional compensation to serve as trustees.

How can shareholders influence the trust?

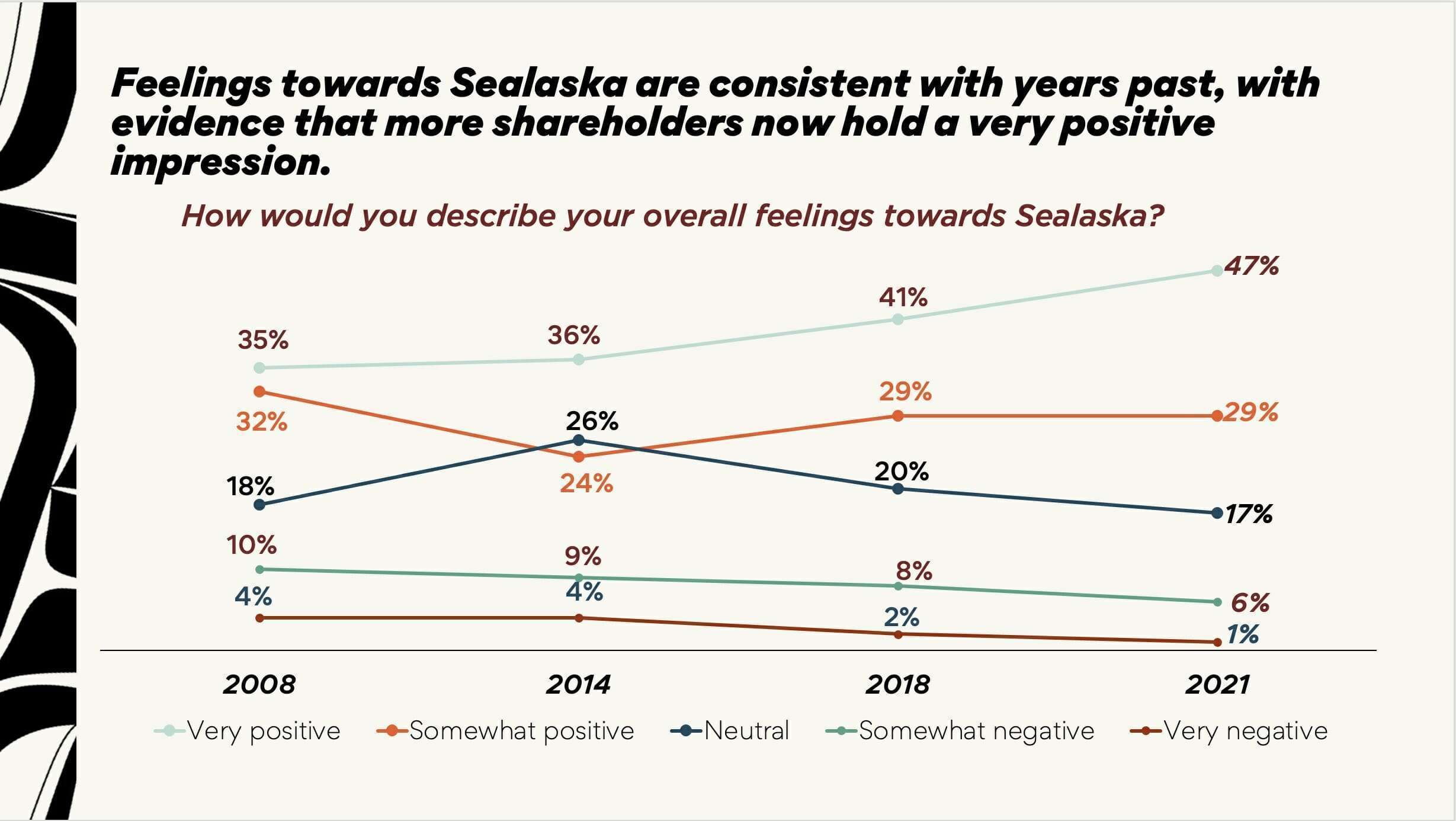

Because all members of Sealaska’s Board of Directors are also trustees, a vote for a board candidate is a vote for a trustee. Sealaska will continue to survey shareholders on a regular basis to assess your priorities and ensure our benefit programs align with your values and concerns.

Will the board of trustees be paid for governing the settlement trust?

There will be no compensation paid to the board of trustees for its work. Trustees are members Sealaska’s Board of Directors and will not receive more than their scheduled compensation as a director.

How does the Trust Agreement protect beneficiaries?

The Trust Agreement is the legal and financial description of what the trust is supposed to do and outlines the responsibilities of the trustees. It is designed to protect the beneficiaries and guide the trustees. The Trust Agreement requires that each trustee act in good faith, solely in the interests of the beneficiaries (shareholders), and with care, skill, prudence and diligence. Trustees are required to bring their attention, skill and focus to the job of managing the trust, just as Sealaska directors are required to do on behalf of shareholders. Because the trust is intended to last indefinitely, the agreement gives trustees the flexibility to amend the trust as needed based on future economic circumstances. The Trust Agreement identifies certain types of changes that require more than “standard” approval by the appropriate body – the Board of Trustees and/or the Sealaska Corporation Board of Directors.