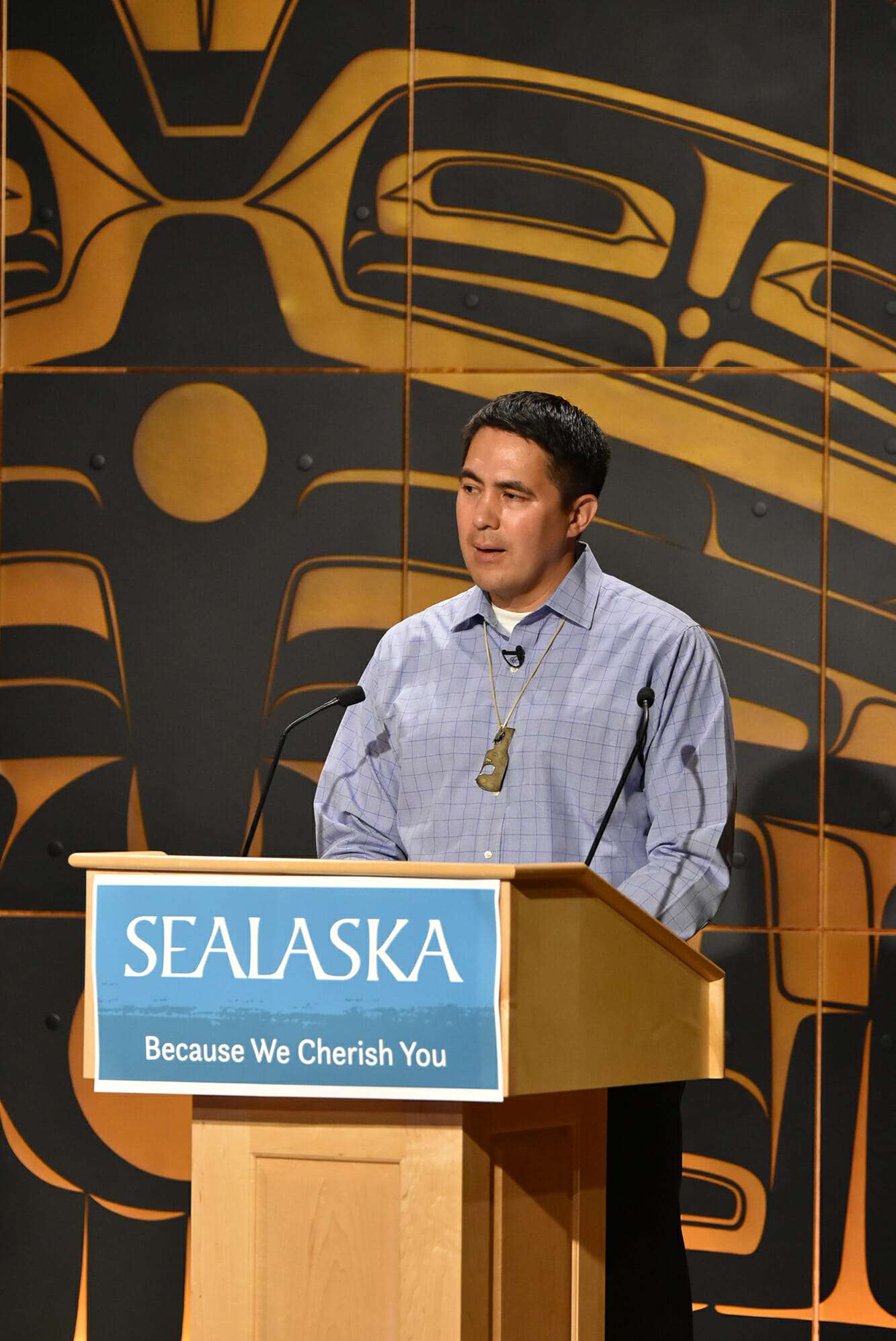

1099 Tax Forms are available now on MySealaska!

Wednesday, January 17, 2024

How to find your 1099-DIV on MySealaska.com

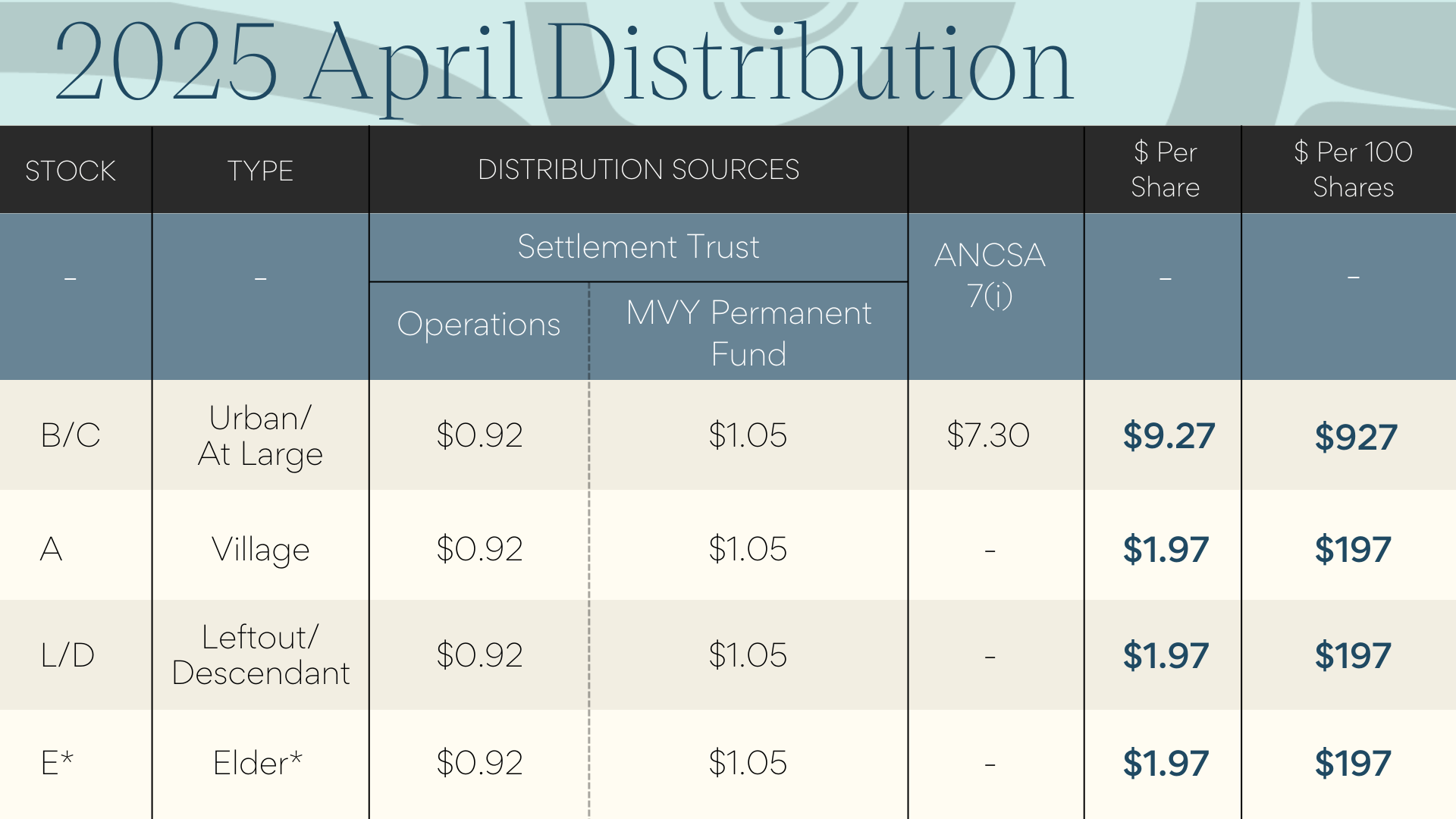

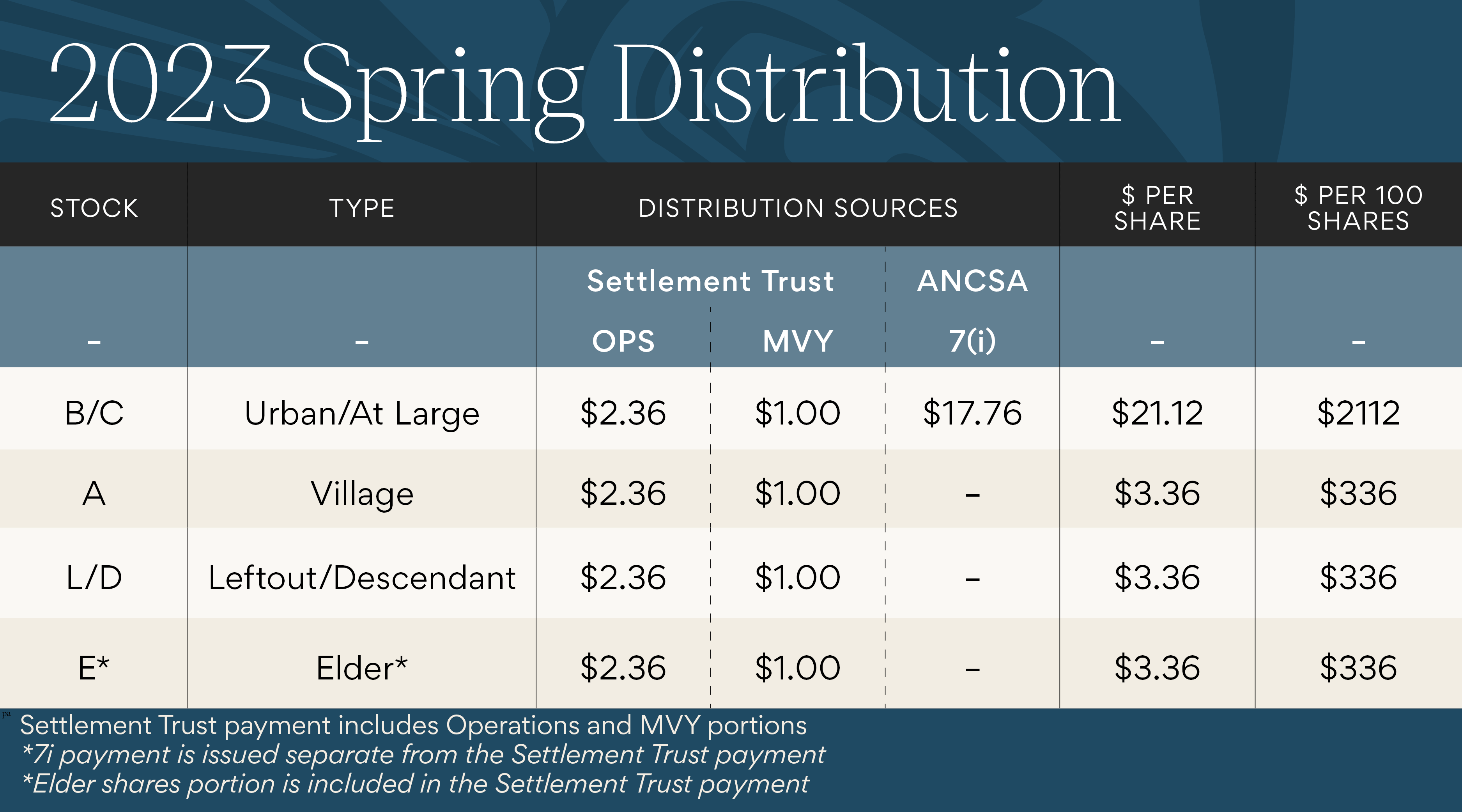

Q: Why am I getting a 1099? I thought my distributions were tax free now that we have the Sealaska Settlement Trust?

A: The Sealaska Settlement Trust was created by a vote of shareholders in June of 2021.

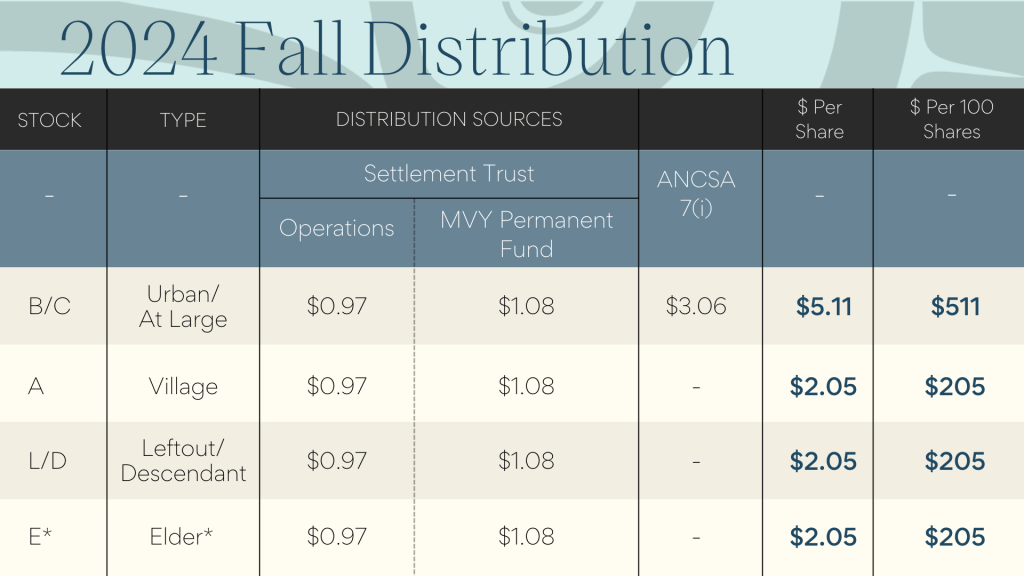

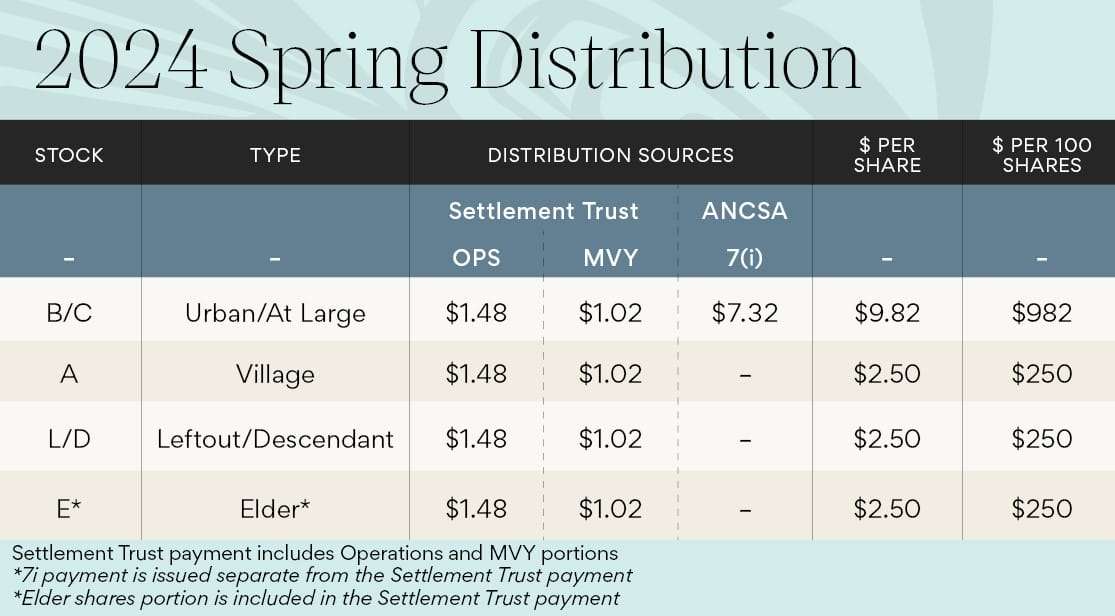

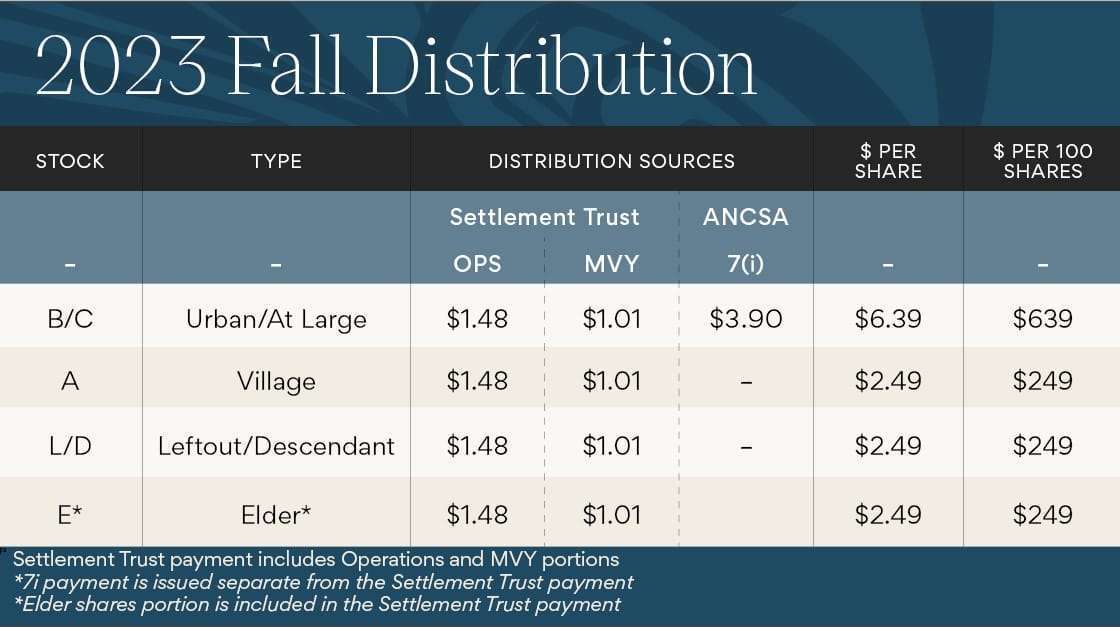

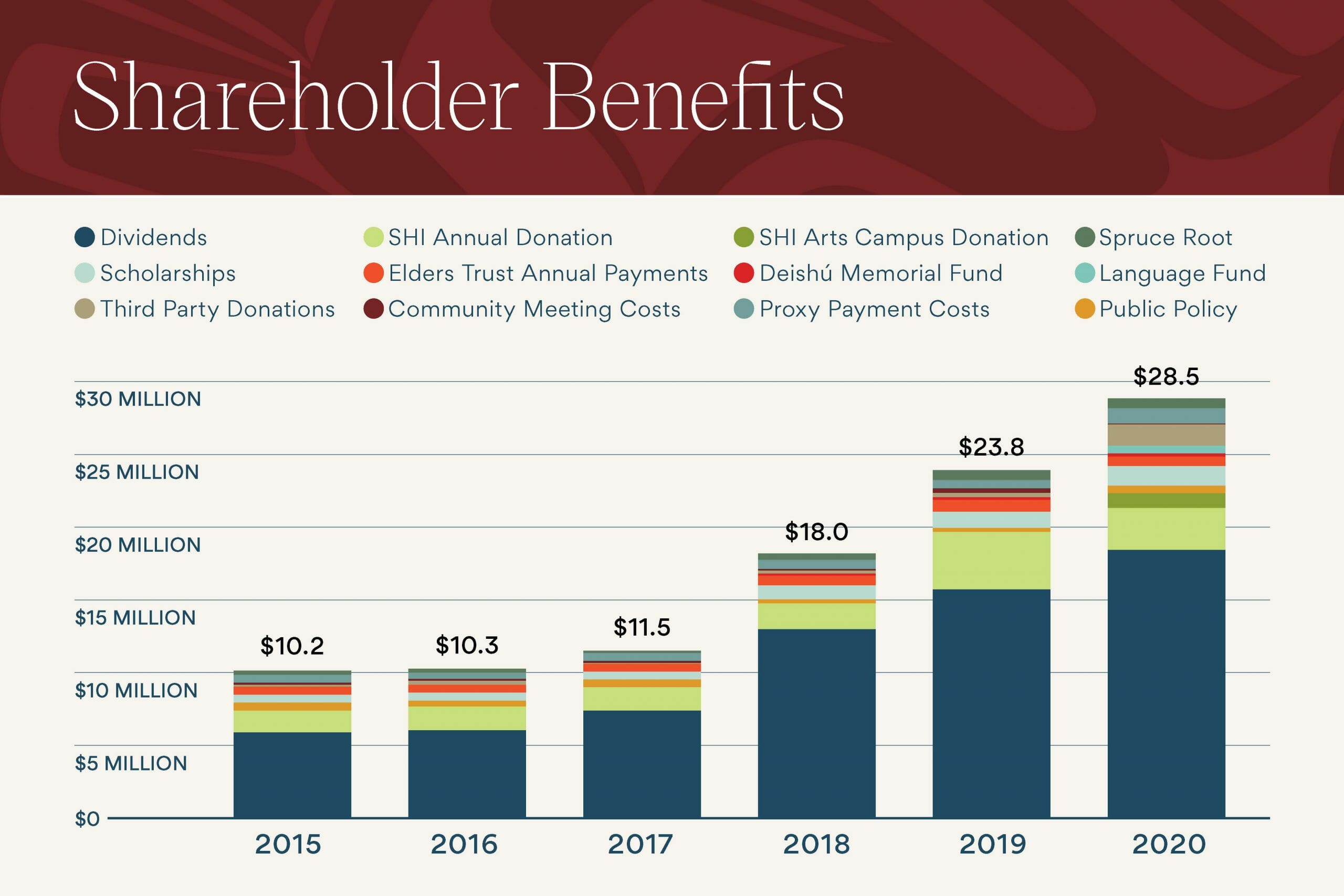

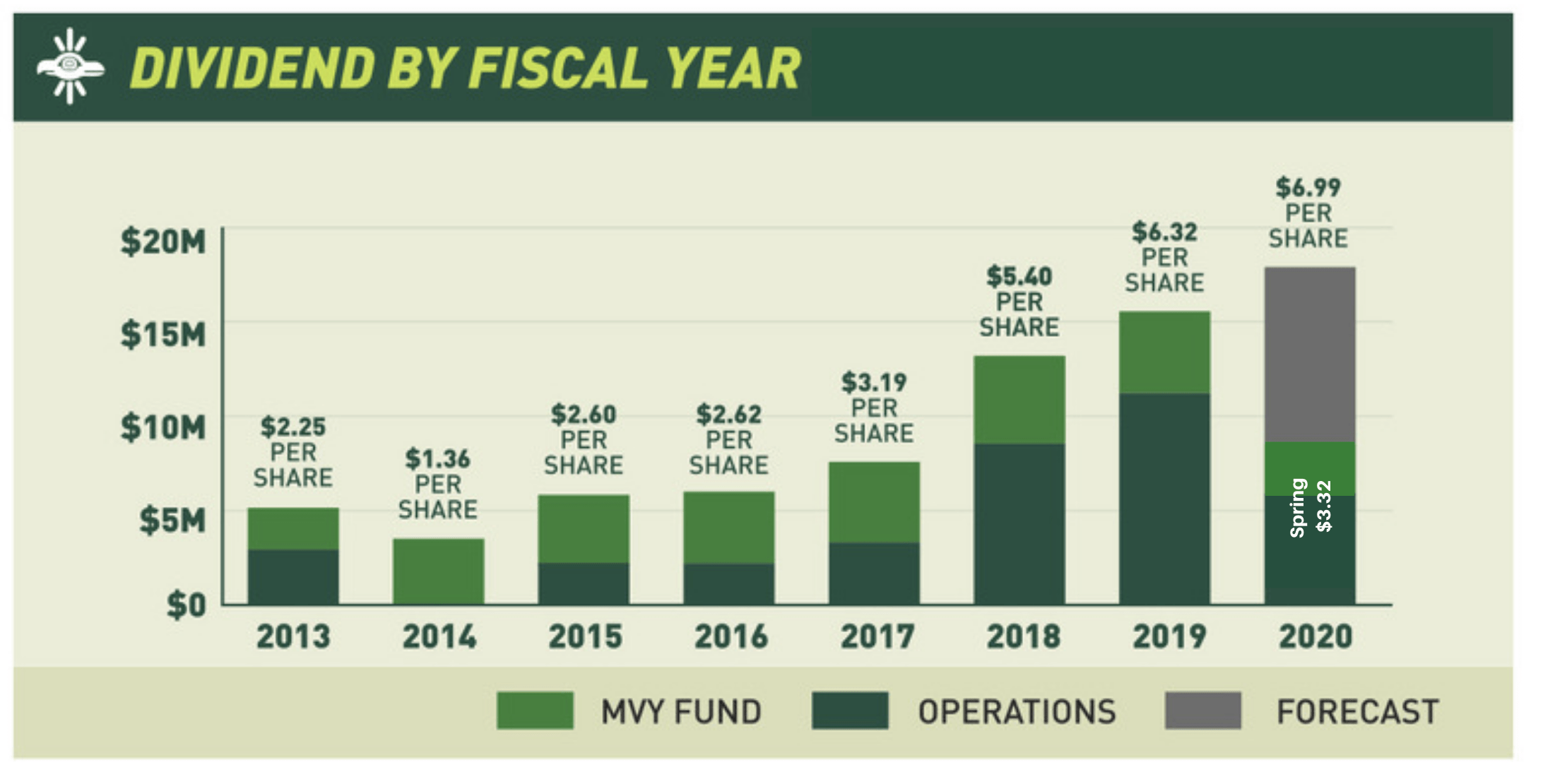

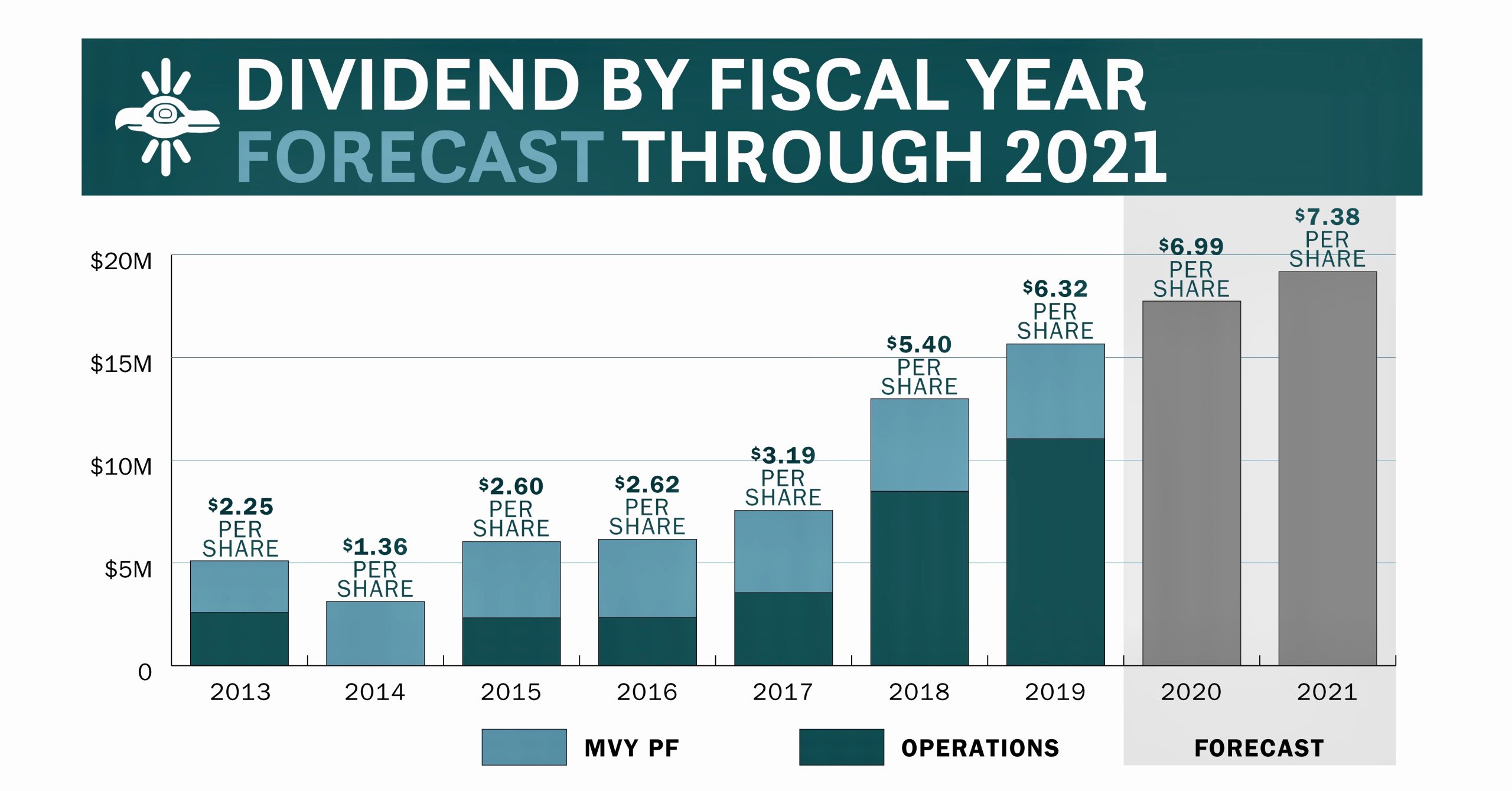

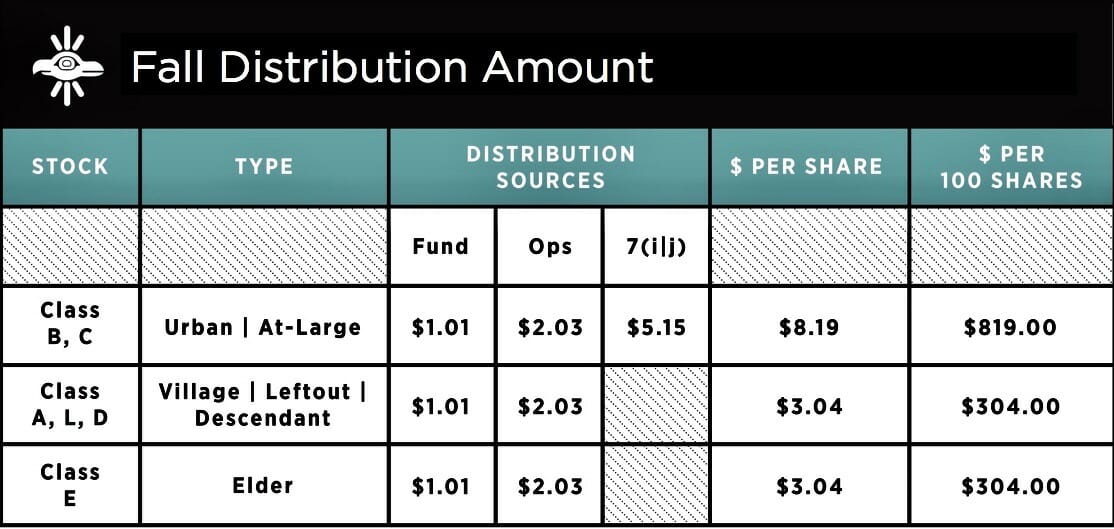

- Distributions from Sealaska operations and the Marjorie V. Young (MVY) investment fund are tax free.

- ANSCA Section 7(j) payments to shareholders (Class B, C) will remain taxable income. Urban and At-Large shareholders (class B, C) will receive a 1099 tax form for 7(j) payments.

- For more information on the Sealaska Settlement Trust, click here.

A: Shareholders who have ONLY Class A, D, or E stock receive their dividends through the Settlement Trust or the Marjorie V. Young (MVY) Investment Fund, both of which are tax free. Shareholders of these stock classes will not receive a 1099 and do not need to report their dividends to the IRS.

News Search

471 results found

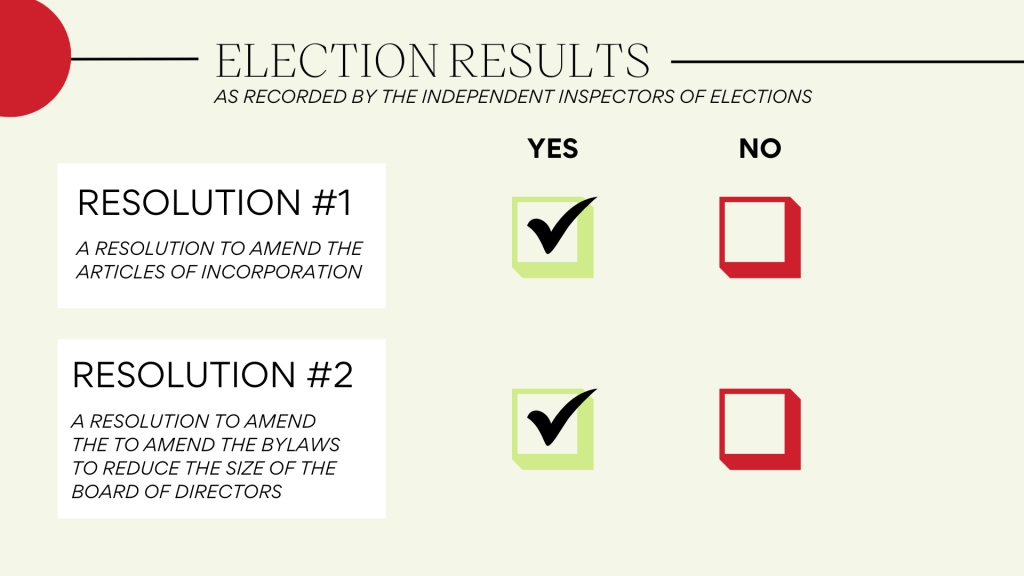

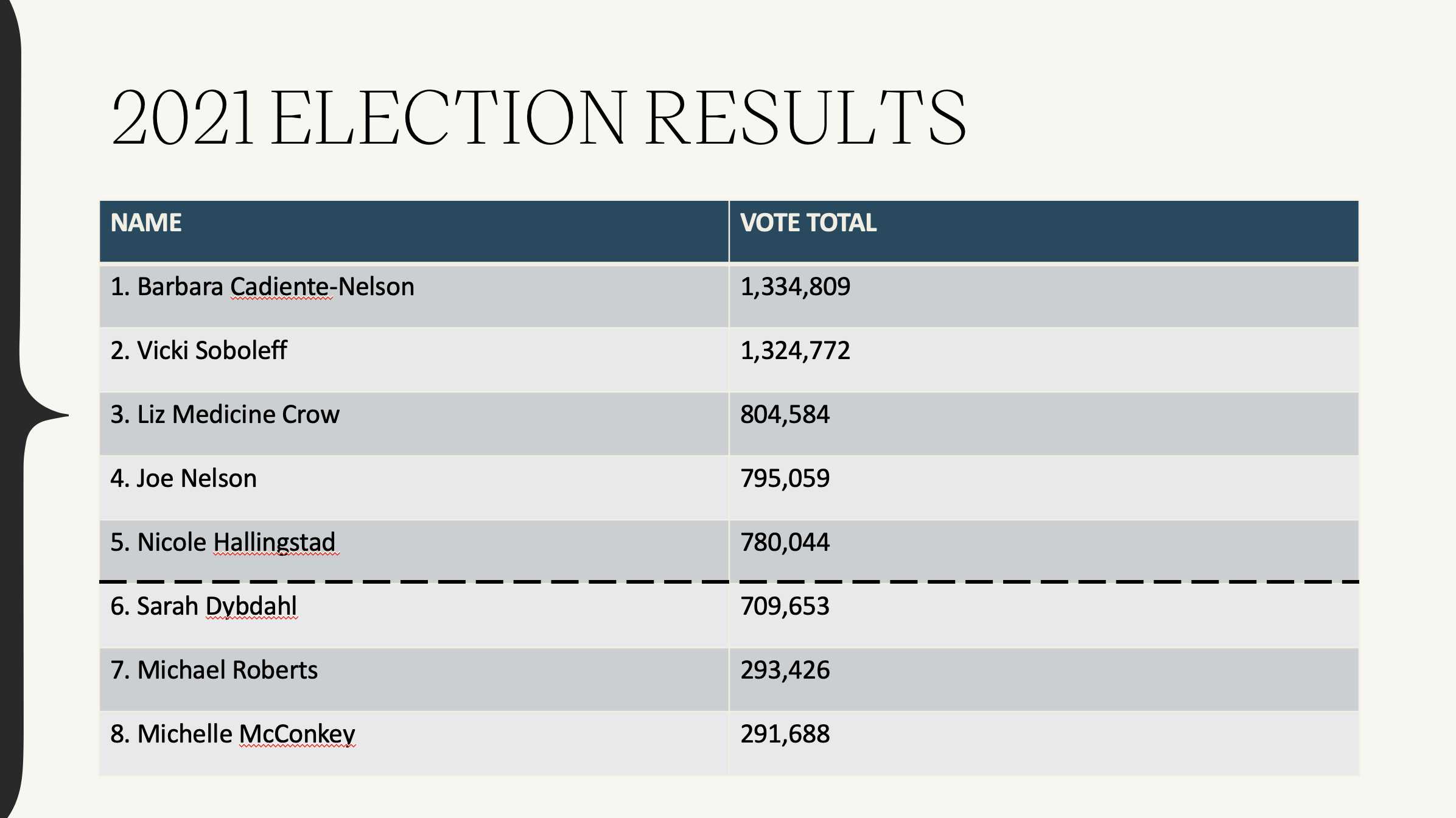

Shareholders, an error occurred when printing proxy cards regarding the number of shares you own and votes you have in the top right corner of your proxy card. This error does not affect the validity of your paper proxy, nor does it affect voting on MySealaska.com through the Election Connection portal

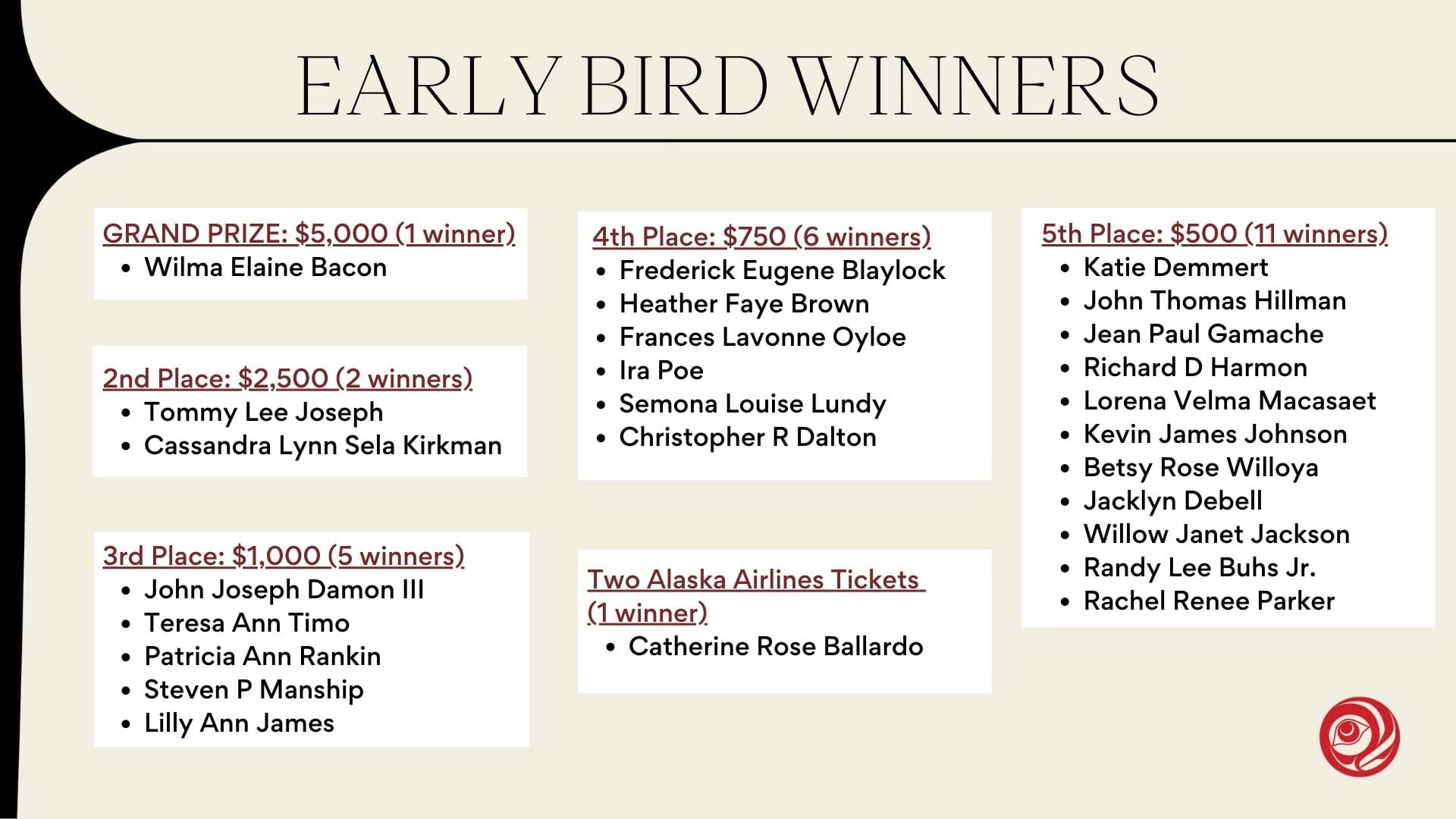

Early birds, it’s your time to fly! Congratulations to our 2024 winners.

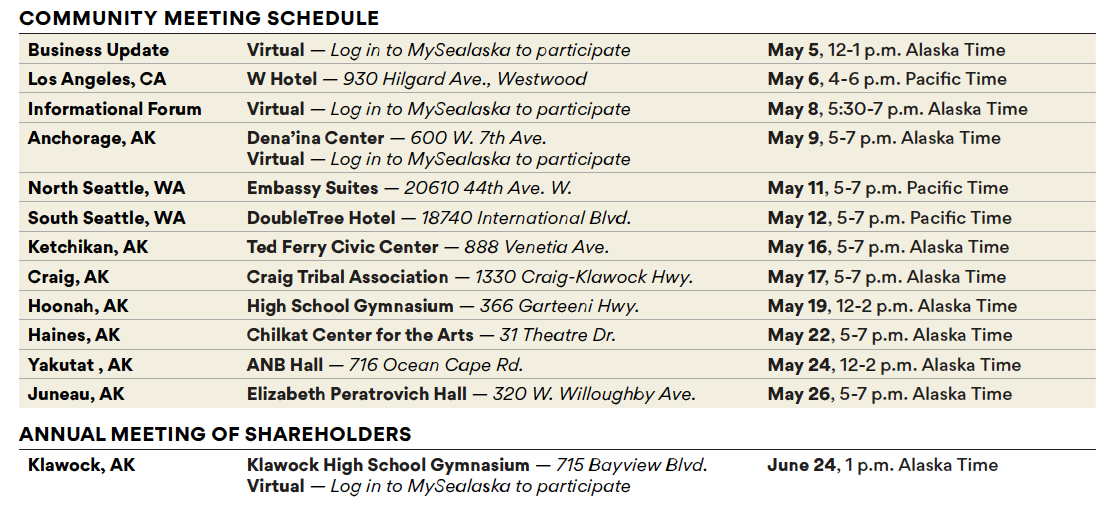

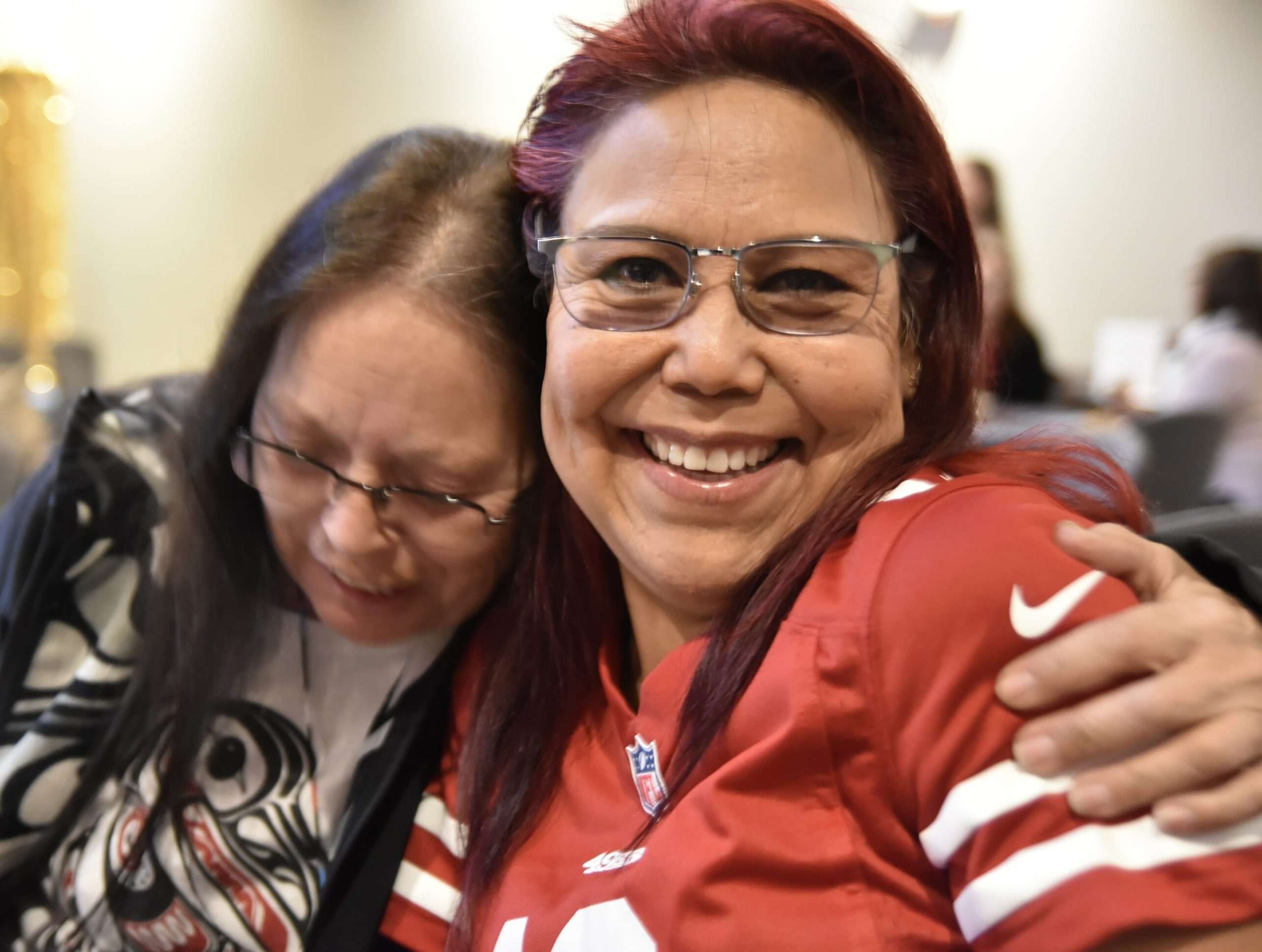

Sealaska shareholders are invited to join us at our upcoming in-person and virtual community meetings to learn more about Sealaska business operations, upcoming opportunities and connect with fellow shareholders and descendants.

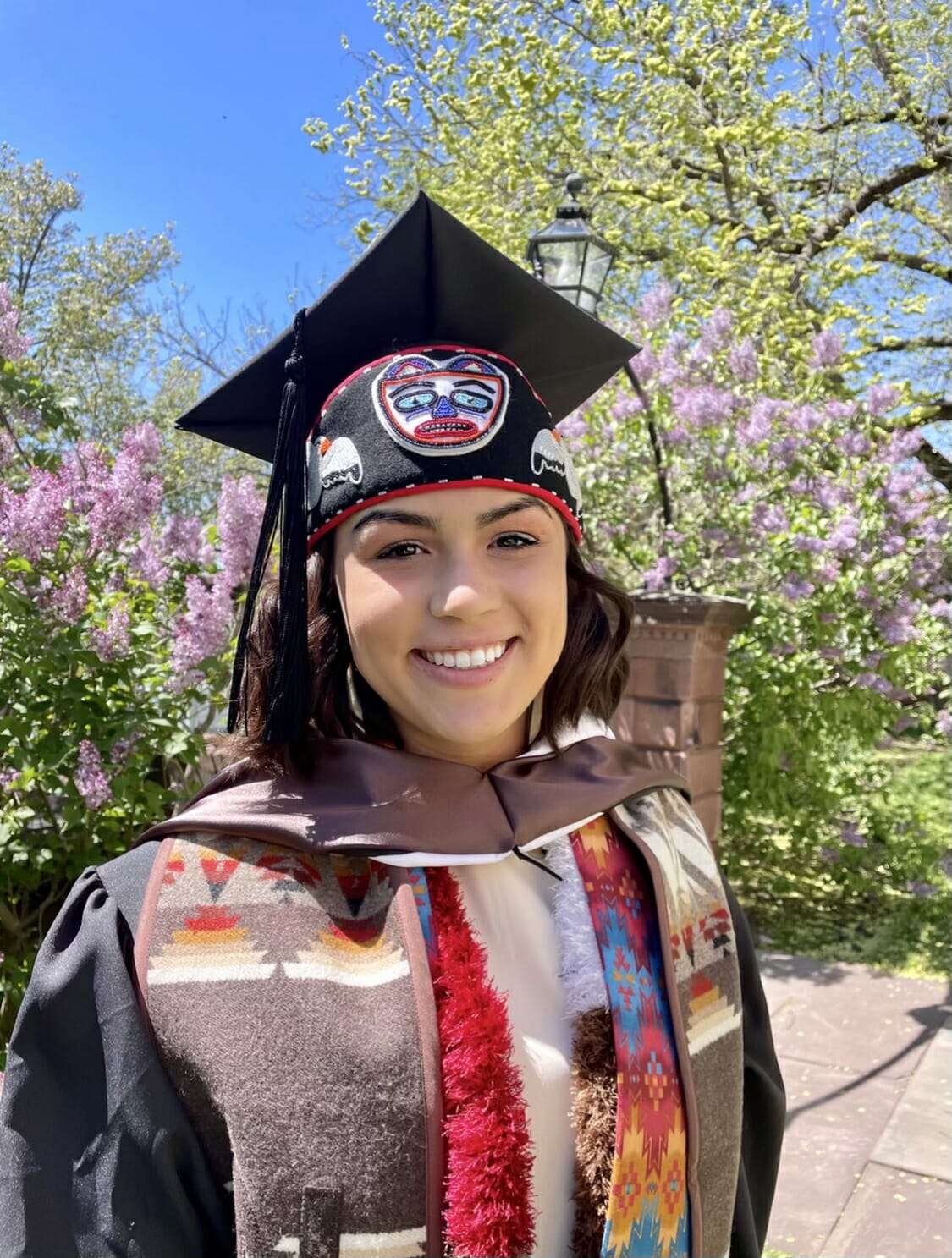

Film is a mirror: Sealaska shareholder descendant Miciana Hutcherson reflects on Black History Month

What Are Shareholders Saying? How does blood quantum impact your life?We asked this simple question and more than 600 shareholders answered, so far. Below are a few of the perspectives we shared via our social channels. Some of these posts you will love. Some you may not. Sealaska has not taking a position, we are …